(Bloomberg) — Stocks rose at the end of their best week in 2024 amid solid consumer sentiment data and bets that newly elected President Donald Trump’s pro-growth agenda will keep fueling Corporate America.

Most Read from Bloomberg

-

Key Ballot Initiatives and Local Races Highlight Views on Abortion, Immigration

-

From Housing to Immigration, Key Ballot Initiatives and Local Races to Follow

Equities advanced for a fourth consecutive session, with the S&P 500 hitting its 50th record this year. The gauge extended its weekly gain to 4.7%. A breakneck rally in Tesla Inc. catapulted Elon Musk’s electric-vehicle maker back over the coveted trillion-dollar mark. The cohort of defensive shares took the lead on Friday after some groups hit “oversold” levels.

A whopping $20 billion flowed into US equity funds on the day Trump claimed victory, according to Bank of America Corp. That was the most in five months, strategist Michael Hartnett said in a note citing EPFR Global. Small caps — which are seen benefiting from Trump’s protectionist stance — attracted the biggest inflow since March.

The S&P 500 briefly topped the 6,000 mark, which “is a psychologically significant milestone, and could invite even more investor interest in stocks, since there is still plenty of money sitting on the sidelines in money market funds and in bonds,” said Clark Geranen, CalBay Investments.

While the post-election rally likely has more upside ahead, Geranen said he would not be surprised to see stocks take a breather before rallying again into year-end.

The S&P 500 rose 0.4%. The Nasdaq 100 was little changed. The Dow Jones Industrial Average rose 0.6%.

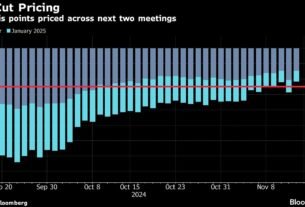

Treasury 10-year yields declined three basis points to 4.30%. The dollar posted a sixth straight week of gains.

Corporate Highlights:

-

Tesla Inc. is now offering the option to lease its polarizing Cybertruck, with prices starting at $999 a month.

-

Paramount Global, the parent of CBS, MTV and its namesake Hollywood movie studio, reported third-quarter sales that missed analysts’ estimates, overshadowing big gains in streaming subscribers.

-

Expedia Group Inc. posted better-than-expected gross bookings in the third quarter and said it was raising its full-year guidance, suggesting that demand has proven stronger than the company had previously thought heading into the holiday season.

-

Airbnb Inc. issued an upbeat forecast for the holiday period driven by “strong demand trends,” a relief to investors who feared that growth was tapering off.

-

Pinterest Inc. forecast weak sales for the holiday quarter, a sign the search and discovery network is struggling to keep pace with larger peers such as Meta Platforms Inc. and Snap Inc.

-

Block Inc., a digital payments company, posted third-quarter revenue that was below analysts’ forecasts.

-

DraftKings Inc., one of the largest-sports betting companies, cuts its full-year estimate for 2024 revenue and profit, citing a tough start to the fourth quarter.

-

Rivian Automotive Inc. said it’s on track to achieve a positive gross profit in the final three months of the year, counting on a surge of regulatory credit sales after production disruptions added to losses.

-

Sweetgreen Inc. shares tumbled after higher labor and protein costs resulted in a wider-than-expected loss for the third quarter.